A review of the value of a company’s assets at different levels can show its position in the market and the potential for sales. Knowing the value of your business can be helpful if you are looking to sell your business shortly or evaluate your standing against your competitors. This article will educate people on business valuation as well as show them how to apply the knowledge they’ve acquired. First, I’ll discuss the process of valuing businesses.

Table of Contents

A review of the value of a company’s assets at different levels can show its position in the market and the potential for sales. Knowing the value of your business can be helpful if you are looking to sell your business shortly or evaluate your standing against your competitors. This article will educate people on business valuation as well as show them how to apply the knowledge they’ve acquired. First, I’ll discuss the process of valuing businesses.

Business Valuation An Introduction

A business’s valuation can be used to establish its value of a business. It considers all aspects of a company and its components to determine the value of the company in terms of dollars. A precise valuation is required for selling a company, or the sharing of its assets during a divorce, tax divorce, or marital property disputes. Furthermore, businesses often employ third-party business assessors to provide an impartial appraisal.

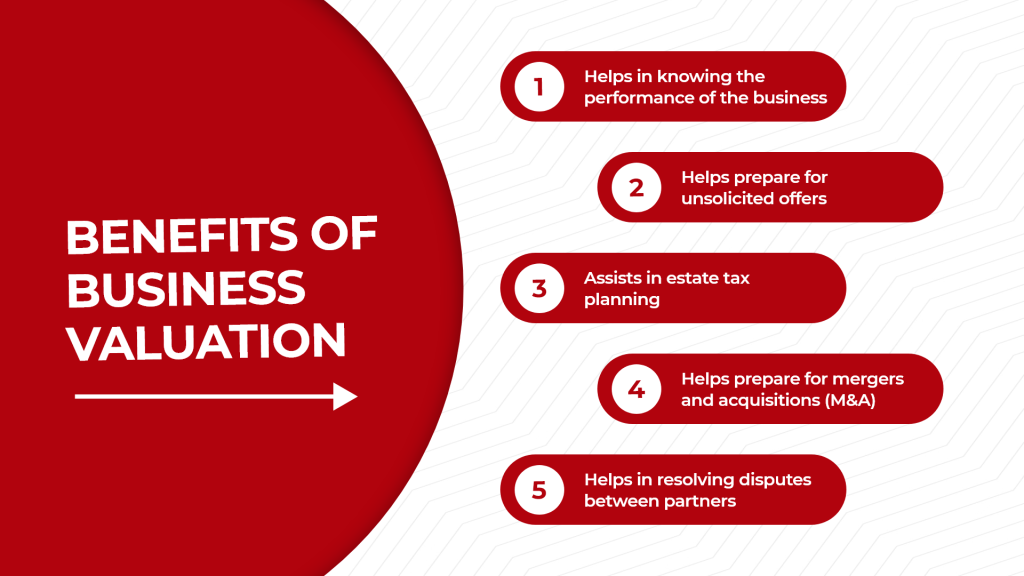

Benefits of Business Valuation

Helps to understand the business performance

A business valuation can help understand the performance of a business.

The procedure for business appraisals involves a five-year review of records. The business valuer analyzes growing trends and trends from a variety of perspectives.

The business valuer will analyze the company’s liquidity levels and leverage, coverage, and operational ratios over the past five years. They will also prepare a specific financial analysis for the industry.

Owners of businesses can conduct an independent assessment of their health and performance. The report explains the company’s growth efficiency, profitability, debt capacity, and liquidity.

Comparing every indicator with the industry standard helps managers evaluate the company’s performance.

This research is helpful to benchmark. Utilizing statistical research, managers and investors as well as others interested parties can learn about the growth of a business and its financial health.

This operational analysis provides the CFO with the needed objectivity and aids in managing financial responsibility. Financial tasks for corporate finance include financial planning and capital allocation, risk assessment as well as financial analysis and forecasting.

With this knowledge, the CFO can make strategic and smart decisions that assist the organization in the coming years.

Helps by delivering unsolicited offers

Unsolicited offers to buyouts can be shocking for business owners. But, you might not be aware of the business’s worth.

Businesses are likely to be relying on unreliable market data such as inaccurate agreements however, the business is overvalued if there is no credible information on sales and market trends.

Sudden death or incapacitation of a business owner can cause disruption. The event could trigger a buy-sell arrangement and also the redemption or sale of the affected parties’ company shares. Regular business valuations can assist companies with unanticipated events. Better results are a result of managing expectations.

The company’s worth can help prevent disputes with buy-sell agreements in private firms with lots of equity investors. An appraiser can assist legal counsel to assess the worth of a buy-sell contract. This will allow a fair price for the trigger incident’s specific circumstances. Annual valuations should determine an equity’s worth. For instance, one valuation after trigger events may increase the chance to be a victim of biased claims.

Resolves partner disputes

Multiple variables might cause partner conflict. Conflicts between shareholders and purchases are not uncommon. Conflicts over contracts arise when both parties violate the agreement’s conditions, for example, failing to finish the project or provide promised services. M&A or PE investments can trigger acquisition and shareholder disputes.

Mediation and arbitration are becoming more common. The ability to evaluate a business accurately can help resolve disputes. A variety of facts could result in disputes. The end of a corporate partnership or disputing an unsuccessful merger are two instances.

Arbitrators are required to choose between contradicting expert opinions when these differences occur. In the beginning, both sides provide expert opinions. Each side will develop its value analysis based on evidence that it believes is most supportive of its position.

A complete and precise valuation model can help to effectively communicate conflict resolution decisions. It explains the essence of an expert’s function in litigation or conflict resolution.

Aids in estate tax

A firm may perform an estate tax valuation. The Business valuation can aid in any future tax planning, reduction, or even payment.

If a company has to pay inheritance taxes but does not try to deflect them then its estate has to be liquid. Tax planning will help business owners ensure their successors’ financial level as well as the business’s profit from tax obligations.

A business value can help estimate estate taxes. Business worth could assist the owner as well as his advisers to reduce the estate.

prepares to deal with mergers and acquisitions

Anyone who is planning to buy should know the price they are asking for. Any company that wants to sell must be aware of the price a buyer is willing to be willing to pay. If a business is merged with another, it needs to determine how to divide ownership appropriately. The split of ownership can be calculated based on the firm value before the merger or purchase.

Business valuation is among the most critical aspects of M&A because it determines a business’s fair value.

Realism and accuracy in the determination of firm values impact the negotiation process and the post-M&A period. Research shows that a lot of M&A deals fail or are overpaid by the company that is being targeted. Unreliable corporate valuations can cause this.

The M&A does not provide the expected synergy. “Synergy” refers to the increased value of a merger. The added value opens up opportunities that would not be there when the two businesses operated independently.

Business valuation isn’t only for business owners who wish to assess the value of their business. It can help increase profits from a sale, merger or acquisition, JV, and strategic alliance.

The value of a business is based on the profitability of its operations, cash flow, and the value of money. It is used to determine the amount the company will pay to acquire another, as well as the discount rate of the potential cash flow.

Methods of Business Valuation explained

An Asset-Based Strategy

The worth of a business is usually measured by the value that its tangible assets like machinery and buildings. It’s crucial to recognize that the company’s intangible assets could be just as important as its physical assets. The list of intangible assets comprises copies of patents, copyrights, and patents, as well as clientele and vendor connections. When valuing a company using the asset-based method, you must consider its tangible and intangible assets.

If the assets of a business are put together this is how much it’s worth. In contrast to the more typical earnings-based method, the one here doesn’t focus on future or past performance. Instead, it analyzes the market value of the company’s assets to determine the assets’ present market value.

Market Value Value Approach

A method to determine the value of a company is using the market value method which takes into account comparable companies to determine an amount. This technique is commonly used to evaluate family-owned and privately-held companies. Assessors will examine the sales of similar businesses to determine an estimate of the present market worth. This kind of information is accessible from a variety of sources, such as private deals, government agencies, and brokerages that focus on business. Once all the data is gathered then it could be used to determine the range of value for the company.

The Earning Method

An earnings strategy is a method to assess the value of a company by looking at its current and expected earnings. “income approach” is a term used to describe this strategy “income approach” can be used to describe this approach. The strategy of earning can employ either earnings from the past or forecasts for the future as the principal data source. The historical earnings of a company are simply financial results that were recorded in the recent past. Forecasts for earnings look at the future and incorporate factors like expected expansion, market changes, and so on.

The earnings method used to assess a company’s value requires consideration of two essential aspects: discount rates and capitalization. Uncertainty and time are expressed in the discount rates. It is the amount that the investor will pay for an uncertain stream of income. The discount rate will rise proportionally to the amount of risk. The estimation of a company’s value by analyzing its projected or past profits requires capitalization rates. It will tell you the amount of money you are willing to pay for every dollar that you earn.

Conclusion

This article provided readers with an introduction to the valuation of businesses, outlined the numerous benefits of valuations, and outlined the various methods employed to assess the value of a company. The basics of valuation for the business, as well as important details about the background, are explained.

If you’re an owner of a business and require business valuation experts’ services, look to Arrowfish Consulting. We employ business appraisers who have more than 100 years of combined experience which makes us an ideal resource for anyone in need of professional appraisal services. The “qualified appraisers” are familiar with IRS guidelines regarding estate and gift valuations, and you can be sure of your valuation being approved. Additionally, we haveon staff accredited valuation experts (CVAs) as well as CPAs certified by the public accounting profession (CPAs) chartered financial analysts (CFAs) Financial analysts (FAs) as well as economists.

More Stories

Should You Choose Paint Sealant or PPF Coating for Your Vehicle in Gainesville, GA?

Is a Toyota Tacoma the Best Choice for Denver Drivers? Your Complete Guide to Finding the Right Pickup

Expert Review: How to Buy and Sell Precious Metals Safely