What Exactly Is Business Valuation?

In its most basic sense, the business value is the method of determining a business’s worth in economic terms.

As you’re aware there are a variety of methods to assess the worth of a small-sized business but generally, each method will involve an exhaustive and impartial assessment of all aspects of your business. In addition the assessments of business valuations typically contain the value of your business’s equipment and inventory, properties and liquid assets, as well as any other items of importance to your business. Other aspects to consider are your management structure, expected earnings and share prices revenues, and more.

Purpose of a Business Valuation

Due to the complexity of the process of valuing businesses These calculations are not likely to be done every day. When do you need an appraisal of your business?

In the end, there are a few common reasons that entrepreneurs should evaluate the worth of their business:

If you are looking to sell your company

If you are looking for business finance or investors

In determining the percentage of ownership for a partner

When you add shareholders

To facilitate divorce and

For specific tax reasons.

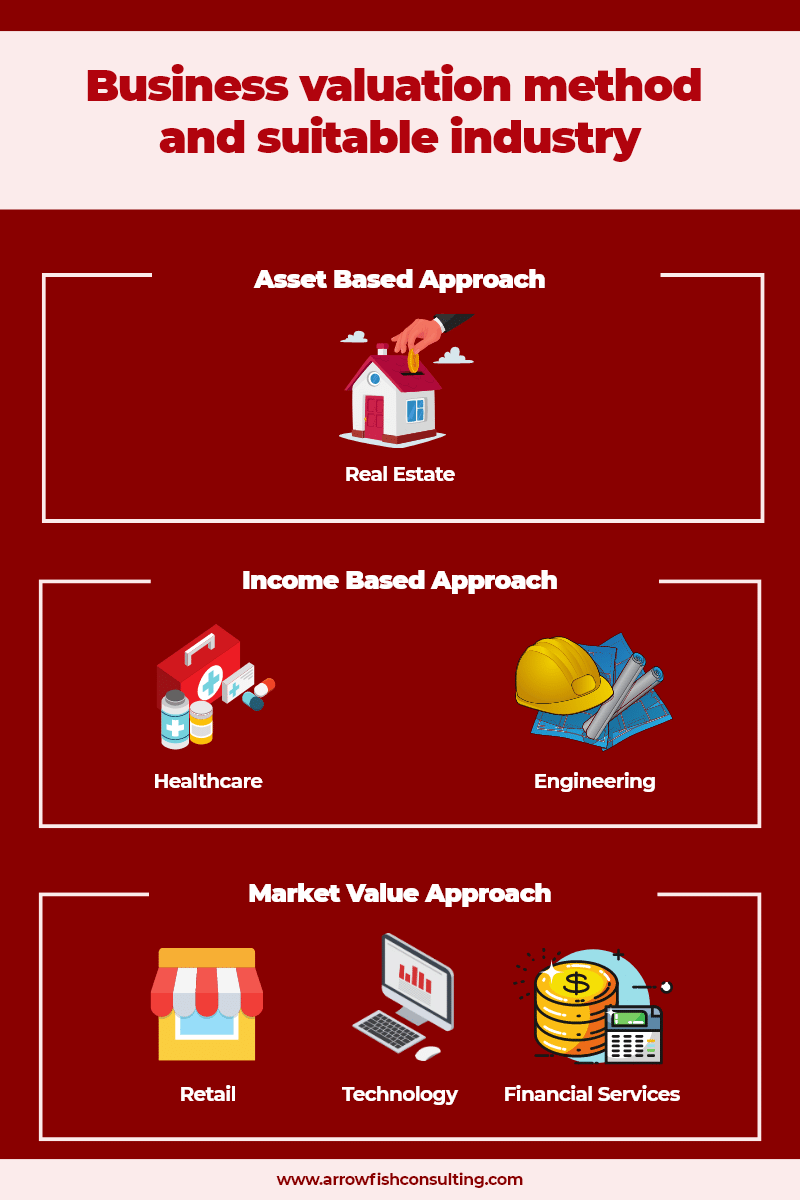

Different methods for small-business valuation are more effective in various situations. The most effective method will be determined by the purpose of the evaluation and what size your business as well as your business, among other aspects.

Methods of Business Valuation

Business valuations are an approach to determining the financial worth of your business. This value can be determined using three methods, based on the character of the company and its needs.

The results of different approaches could be quite different. Each approach is developed to tackle a particular situation. Therefore, it is essential to fully comprehend the situation and your company’s requirements in full.

The three methods of business valuation are as the following:

Asset Based Method

The name suggests as the name implies, this method of valuing business assets is dependent on an estimation of the worth of the assets of the company. Also, it is a method of determining how much capital the business currently has. It can be accomplished in two ways.

The first option, also known by”the “going concerned asset-based method,” requires assessors to figure out the value of net company’s assets on the balance sheet, and then divide it by all of the liabilities of the company.

Another method, which uses completely different approaches and calculates the amount of cash that an organization would earn when all its assets were sold off and all its liabilities are paid in full. This is known as “asset-based liquidation technique.”

Techniques based on assets are more appropriate to companies that can clearly differentiate between assets owned by the company and the owners of it. This is not the best choice to a sole proprietorship firm as an example, since the majority of assets in company are the property of the sole proprietor who can use the assets for personal or business purpose.

A business, however, is a distinct entity and is, in actual an artificial being. In this case the identity of the business, which is actually the firm it self, is the owner of all the assets of the company.

Earning Value/ Income Method

The value of a company can be determined by looking at its future earnings potential. This is done by studying the past performance of the company and its financial records , and then applying the results to determine the future financial performance of the company.

This is known by the term “Capitalizing Past Earnings.” In simple words, the revenue-generating capacity of the business is calculated using earnings from the past and forecasting the amount that the business will be worth following a specific time.

The income-based method incorporates an “discounted Future Earnings or Discounted Cash Flow (DCF) mechanism.” Instead of taking into account future earnings based on the records the calculations are based on the expected future cash flows. The forecasted value is then adjusted to current rates in order to calculate the current value of the company.

An organization that opts for this method of valuing business should have established operations which generate a substantial portion of its income. If you decide to calculate how much you value your business by using discounted future earnings you should have market-based goodwill and a history of customers and a revenue generation strategy for your estimations.

Market Value Method

This is an easy method to determine the worth of your company is calculated by comparing the company’s results in sales and market performance to the performance of a similar company.

For instance, if a lot of your competitors sell their businesses in the same way, a certain purchasing rate will be established for businesses similar to yours.

Take a look at the value your competition were able to sell their businesses for to figure out the value of yours. This will tell the value of your business is worth should you decide to sell it now. This method is effective in highly competitive industries that has regular buyouts.

You might be interested in reading: A Complete Guide on Asset-Based Business Valuation

Which Business Valuation Method Should You Use?

It is essential that the method of business valuation you select is appropriate to the specifics of your business and is in compliance with all legal requirements.

For instance, even though the approach of earning value is an acceptable method to determine the worth of a company but you must establish solid foundations to your calculation.

Every assumption must be backed by evidence of physical reality and evidence. The forecast shouldn’t be based on scenarios that are unlikely to happening at all. In addition, it is important to realize that the worth of a small-sized business is different than that of a larger company. Smaller companies face difficulties including unclear ownership of assets and the dependence on single proprietorship and even the absence of evidence-based documents.

It is, however, an extremely saturated industry since over 90% of businesses have small to medium-sized businesses (SMEs). In this scenario an approach based on market forces would be more appropriate than an income- or asset-based method.

The Bottom Line

It can be difficult to determine the value of your business especially when you consider the many different methods that could be used to evaluate the company’s worth and determine its worth.

In the end, it’s safe to affirm that one approach isn’t necessarily better than another however, the best estimation of your company is likely to come by integrating a variety of different business value methods.

Business valuation is a vast array of applications, ranging from aiding with the transition of ownership of a company to helping to orchestrate strategic decisions like acquiring financing, expandingor merging and buying.

It is crucial that the method and technique employed be selected with care since incorrect calculations could result in significant financial losses in the future.

More Stories

Great Expectations Floor Restoration Boise: Bringing Your Hardwood Floors Back to Life

On-Site Public Insurance Claims Adjuster Los Angeles: Why Local Expertise Makes All the Difference

Renovate Builders Remodeling Seattle: Transforming Homes with Expert Craftsmanship